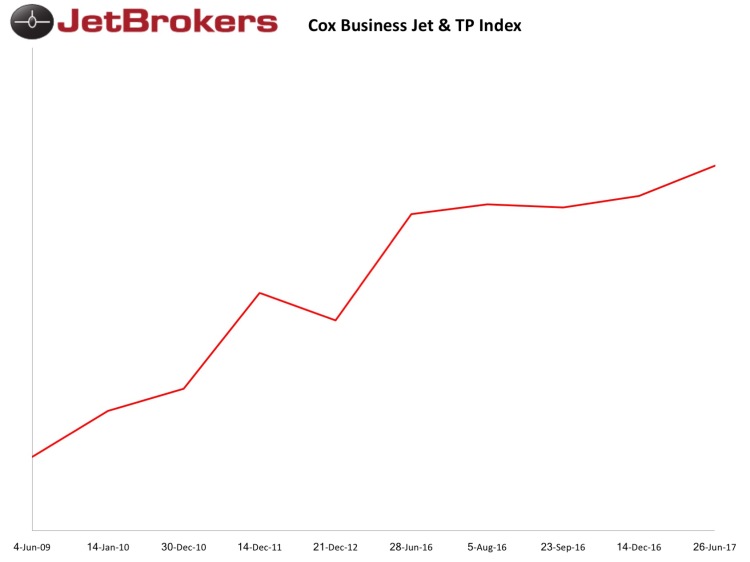

Cox Business Jet, and TP Market Report

It is all about the number of Retail Sales

The Cox Jet & TP Index indicates a rise during the past 6 months, for two reasons:

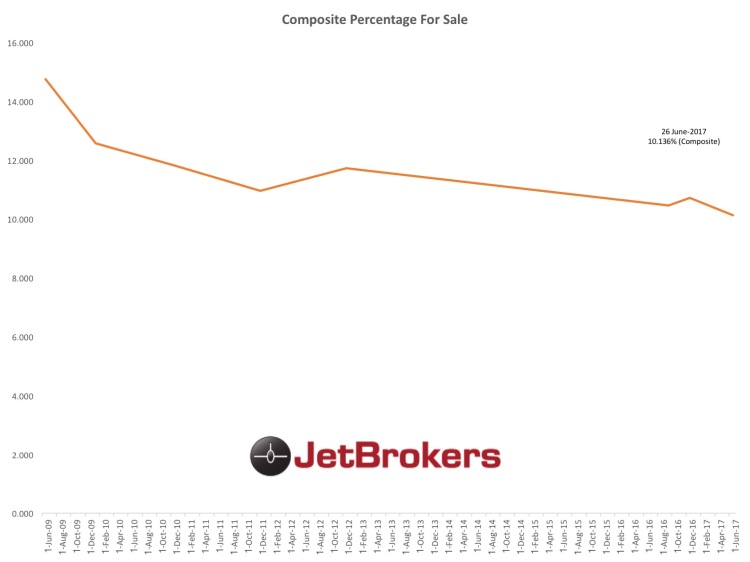

- The Percentage of Aircraft For Sale has gone down by 42 percentage points, overall (1% = 100 points), but the ‘Percentage for Sale’ of the Aircraft used to create the Cox Market Composite Index, has dropped by 59 percentage points

- The Dow Jones Industrial Average continues its upward march

However, the used Business Jet, and Turboprop market is not as healthy as it was 6 months ago, as indicated by the following data points:

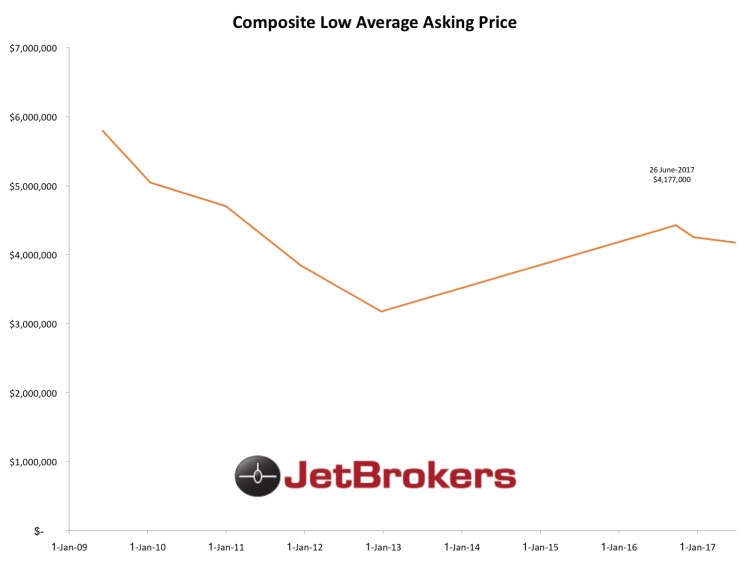

- The ‘Low Asking Price Average’ of the Cox Market Composite Index has dropped by almost $81,000 (from $4,257,955, down to $4,177,000)

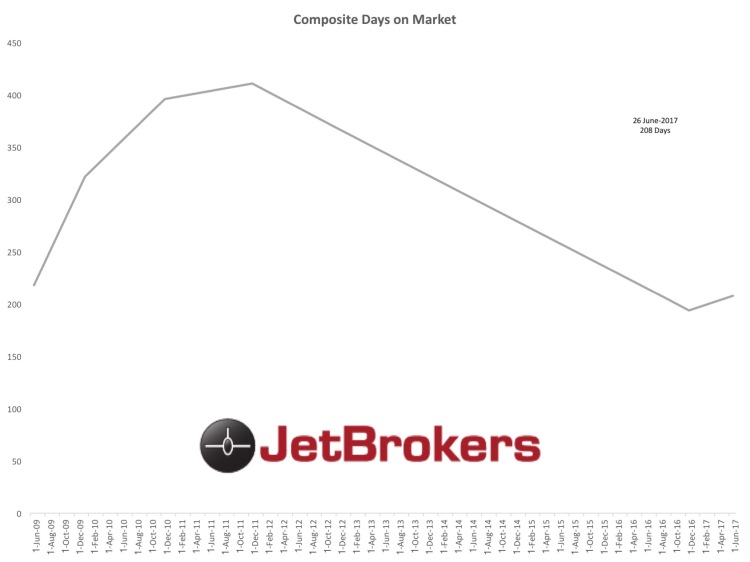

- The ‘Days on Market’ of the Cox Market Composite Index has increased by 2 weeks (from 194 days, to 208 days)

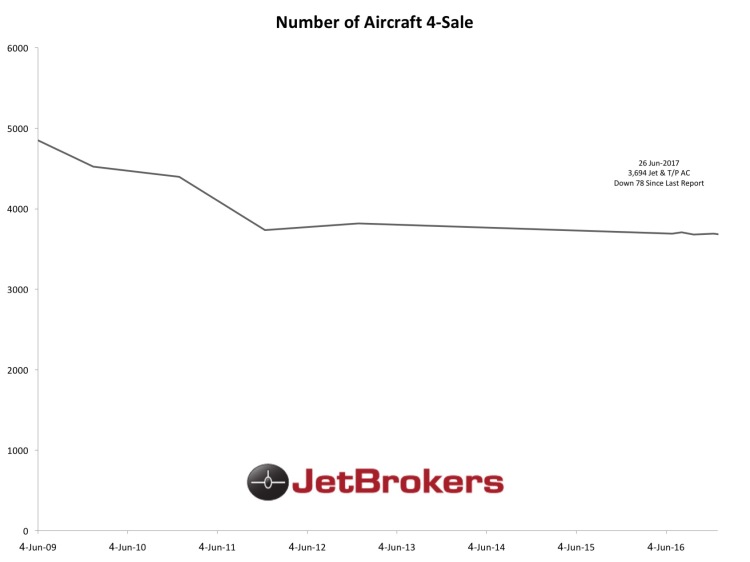

A better way of illustrating the current health of the used Business Jet, and Turboprop market, is by analyzing the number of ‘Used’ Retail-to-Retail, Sales Transactions, by Quarter, since the economic plunge that was the Global Financial Crisis (GFC), to-date:

As you can see from this graph, the data shows that we are currently (Q2, 2017) less than 10% away from the low-point of least sales transactions seen in Q1, 2009. Basically, I believe the reasoning behind this significant data is because: In Q1, 2009, as a large number of business aircraft owners were still realizing the full consequence of the cliff-drop (GFC) that happened in October 2007. Everything, including aircraft changes; either ‘step-up’, ‘downsizing’, or ‘getting out’ of their business aircraft was firmly on hold, hence the significant reduction in Quarterly Sales Transactions during that period. Now today, the same is true on the mindset regarding aircraft changes. But instead of getting to grips with GFC; today a large number of business aircraft owners are sitting still while they await the course of history to provide a readable, and actionable trend, for the following questions: i.e. Is the Trump Administration ‘Making America Great Again?’, or is it piloting the country into a ‘death-dive?’; Is Islamic Extremism going to take over the World, while millions are annihilated in the name of religion?; Is Climate Change a real threat to our planet, or just invented science that uses skewed data?; are we on the brink of the ‘mother’ of all GFC’s?

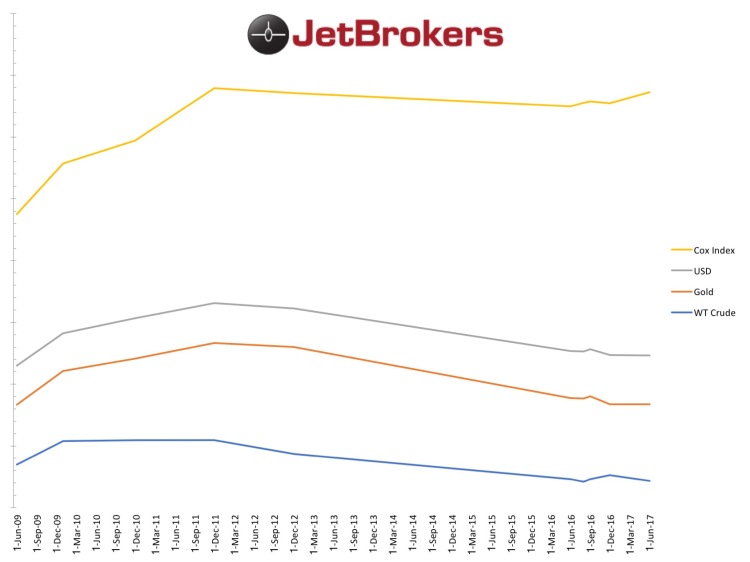

Here are the rest of the Market Report graphs:

So, what Turbine, or High-Performance aircraft are allowed to be flown under the new ‘Basic Medical’ Rule?

Basic Medical Rule effective on May 1, 2017; AKA…Alternative Pilot Physical Examination and Education Requirements

Applies to Part 91 Operations

Eligible Aircraft flown under this Rule, must meet the following requirements:

- Authorized to carry not more than 6 occupants (includes the crew)

- Have a maximum Take-Off Weight of not more than 6,000 Lbs

Operating Limitations required by this Rule:

- Flight, or passengers is/are not being flown for compensation, or hire

- At an altitude that is more than 18,000 feet AMSL

- Not flown outside of the USA

- At an indicated airspeed exceeding 250 knots

So, what Turbine, or High-Performance aircraft are allowable to flown under this new Rule?

Eclipse 500/550 (not Canada models), but flown with Altitude, and Speed Restrictions (Jet)

Cirrus Aircraft Vision Jet, but flown with Altitude, and Speed Restrictions (Jet)

Piper Meridian, with no restrictions except for Altitude (Turboprop)

Piper M500, and M600, but flown with Altitude, and Speed Restrictions (Turboprop)

Twin Commander 500/560/A, but flown with Altitude, and Speed Restrictions (Piston)

Piper 600, and 601 Aerostars, but flown with Altitude, and Speed Restrictions (Piston)

All Piper Aztecs (Piston)

Beechcraft Twin Bonanza, A/B/C Models, but flown with Altitude, and Speed Restrictions (Piston)

Beechcraft 55/58 Barons non P, or TC Models (Piston)

Any 300 Series Cessna (Piston)

I was inspired to write this thanks to a fellow Senior Certified Appraiser, Mr. Ron Herold, President of Airplane-Appraiser.com and based in the Washington, D.C. area. Thank you Ron.

Market Snapshot: Falcon 900 Series

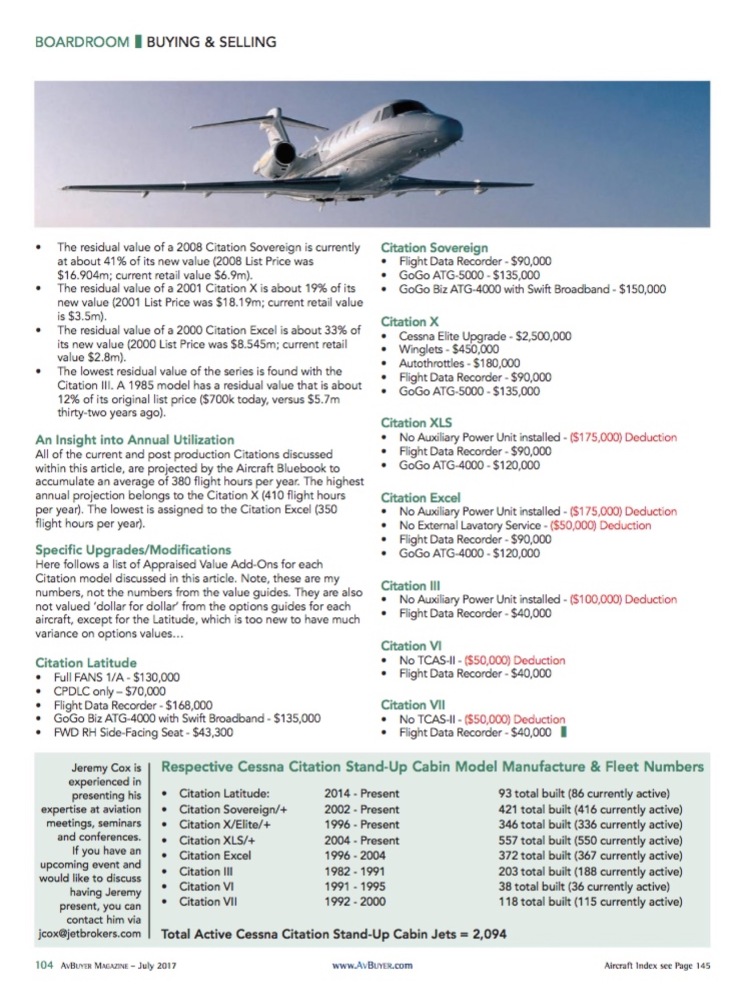

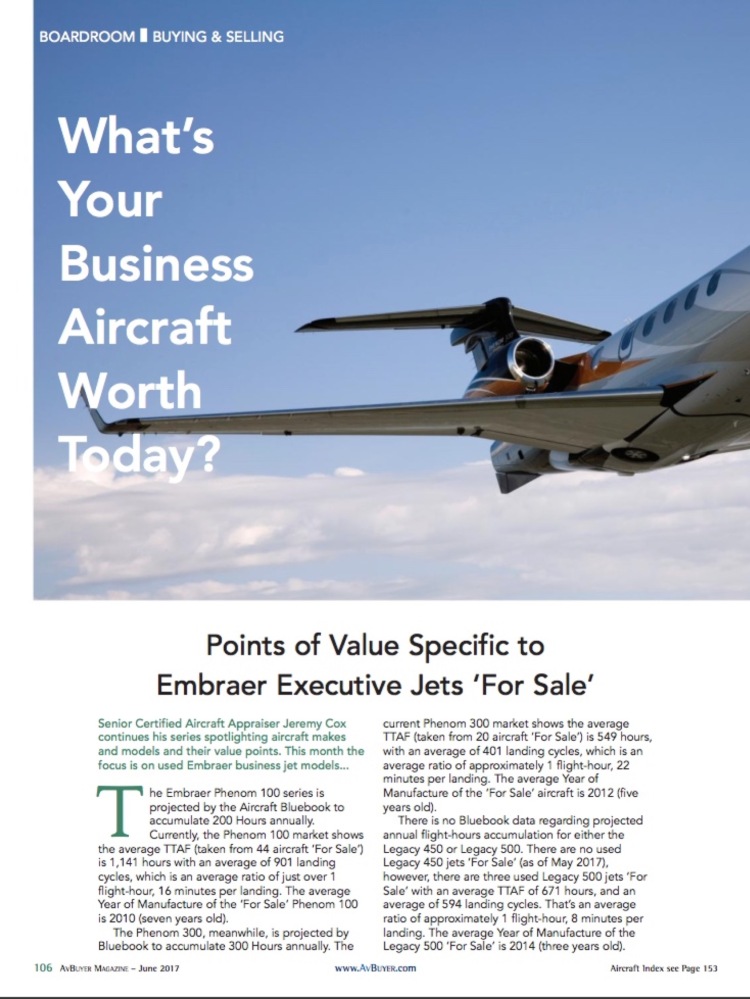

Points of Value Specific to Embraer Executive Jets ‘For Sale’

Points of Value Specific to the Falcon 2000, Falcon 900 & Falcon 7X ‘For Sale’

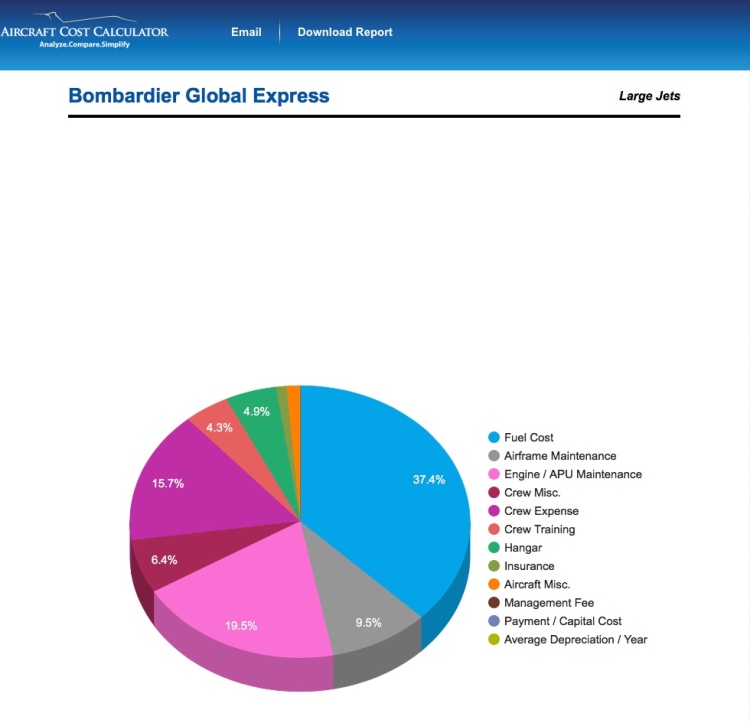

Jet-A Consumption amounts to 25%+ of an Annual Operating Budget, but I remember the days when it was closer to 50%, on-up!

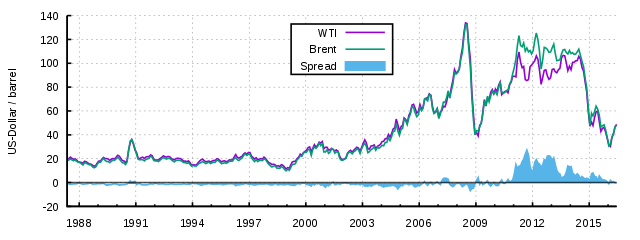

An article written by Curt Epstein was published by Aviation International News, today. It was ‘Headlined’…”FUEL PRICES STAY AT DECADE-LONG LOW POINT. Mr. Epstein reported in his article that “…the price of Jet-A last year was the lowest in a decade, averaging $3.31 a gallon nationwide (25 cents less than in 2015), according to industry fuel data provider Fuelerlinx. The decrease corresponds with data from the U.S. Energy Information Administration, which shows a 30-cent year-over-year decline in the refiners’ wholesale per gallon price for U.S. kerosene-type jet fuel, which at an average of $1.29 a gallon was the lowest in a decade.”

I remember that in 2007/2008, the average price for Jet-A was $7+ a gallon.

Mr. Epstein’s article prompted me to look back through old articles that I have had published over the years, and I came up with a piece that was published in 2005, which read: “…According to the ‘CIA World Statistical Handbook’, out of a total of 212 countries in the world, only 98 of them are actually oil producing nations. Interestingly virtually all of the 212 countries elect to charge a fuel use or consumption tax. According to a recent report published by the French Government titled ‘The oil industry 2004’ the report states that the year: 2013 as “…the time of maximum production or ‘Peak Oil’” That would mean that the world’s oil consumption would reach its highest point around 97 million barrels per day (mbpd). Certain pundits believe that ‘Peak Oil’ will actually occur at the end of this decade (2010), while even others believe that it has already occurred. The Organization of the Petroleum Exporting Countries (OPEC); who account for more than 39% of all crude oil production, and whose member countries hold more than 2/3 of the world’s oil reserves, recently reported that they had opened their spigot ‘wide-open’ and that global oil extraction currently amounts to 85 Million Barrels of oil per day. It doesn’t take much time after thinking about these figures to realize that fuel is not going to drop in price by very much from this point on. So $7.00 per USG Jet A1 delivered into wing at a New York airport, will probably be considered extremely good value in another decade from now.”

Obviously, my prediction of $7.00 Jet-A per gallon was only realized two-years after writing that article, but today I certainly deserve to eat craw, because I could not have predicted that in 2016/17, we would only be paying $3.00 Jet-A per gallon.

Mr. Stephen Moore, an economist who served as an economic advisor to President Trump, during the run-up to the Presidential Election, wrote late last year, in the Wall Street Journal: “…Some naysayers also think that the big reason the price of oil is down is that the economy is down—so a low price isn’t a good thing. Yes, there are good and bad reasons that oil prices fall. The good reason is the supply rises. The bad is a weak economy. We don’t want the world to go into a depression to keep oil prices low. But more supply is always a good thing because it reduces the fundamental economic challenge of scarcity. I also keep hearing that low energy prices are bad news for stocks. Maybe in the very short run. But remember: The two biggest booms in the stock market in U.S. history were in the 1980s and 1990s. In both of those decades, oil prices fell and fell and fell. The worst decade since the Great Depression for stocks was the 1970s, and that was when the oil price soared from $3 to $30 a barrel. We can also put aside the inane idea that America is running out of oil. It was only a few years ago that Barack Obama said in a speech at Georgetown University: “The United States of America cannot afford to bet our long-term prosperity, our long-term security, on a resource [oil] that will eventually run out.” Paul Krugman wrote in 2010 that “commodity markets…are telling us that we’re living in a finite world.” And they both have Nobel Prizes! In reality, America isn’t running out of cheap oil, we are running into it. If we continue to promote cheap, abundant and reliable made-in-America energy, the U.S. within six years can become not just energy independent, but the energy dominant country in the world. That’s spectacularly good news for not just our national economy, but our national security as well.”